Foreign Exchange

View:

May 15, 2024

Preview: Due May 16 - U.S. Apr Housing Starts and Permits - Housing sector losing momentum

May 15, 2024 2:02 PM UTC

We expect April housing starts to rise by 4.5% to 1380k after a 14.7% March decline while permits fall by 1.2% to 1450k after a 3.7% March decline. This would be consistent with the housing sector losing some momentum entering Q2 in response to rising mortgage rates in Q1.

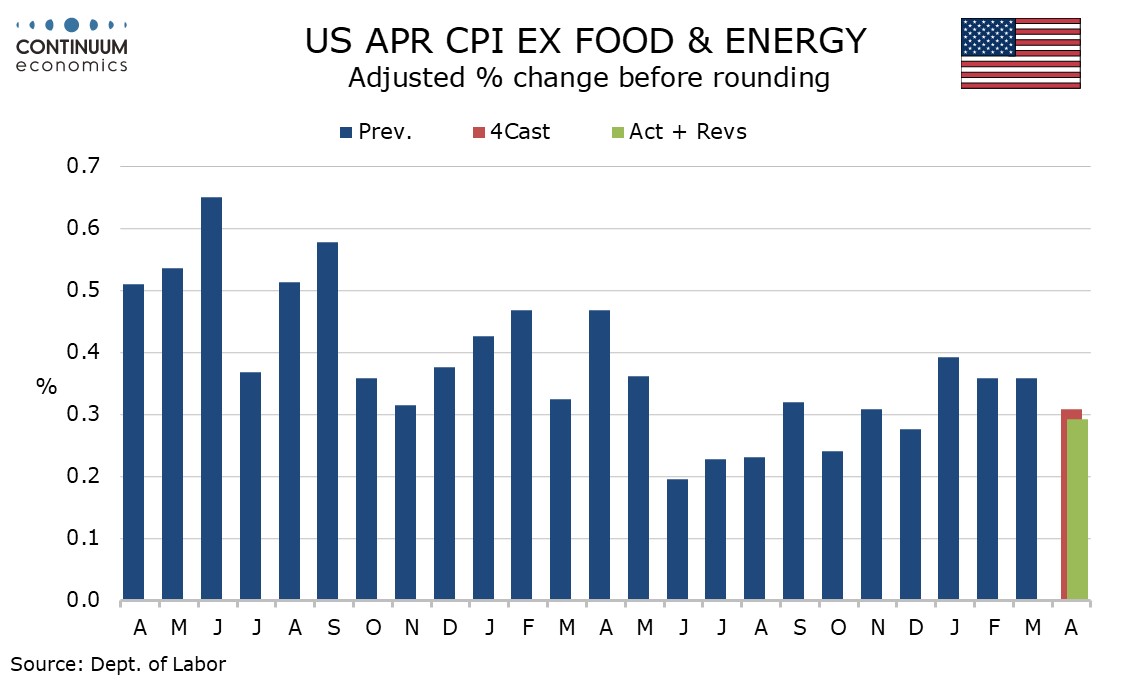

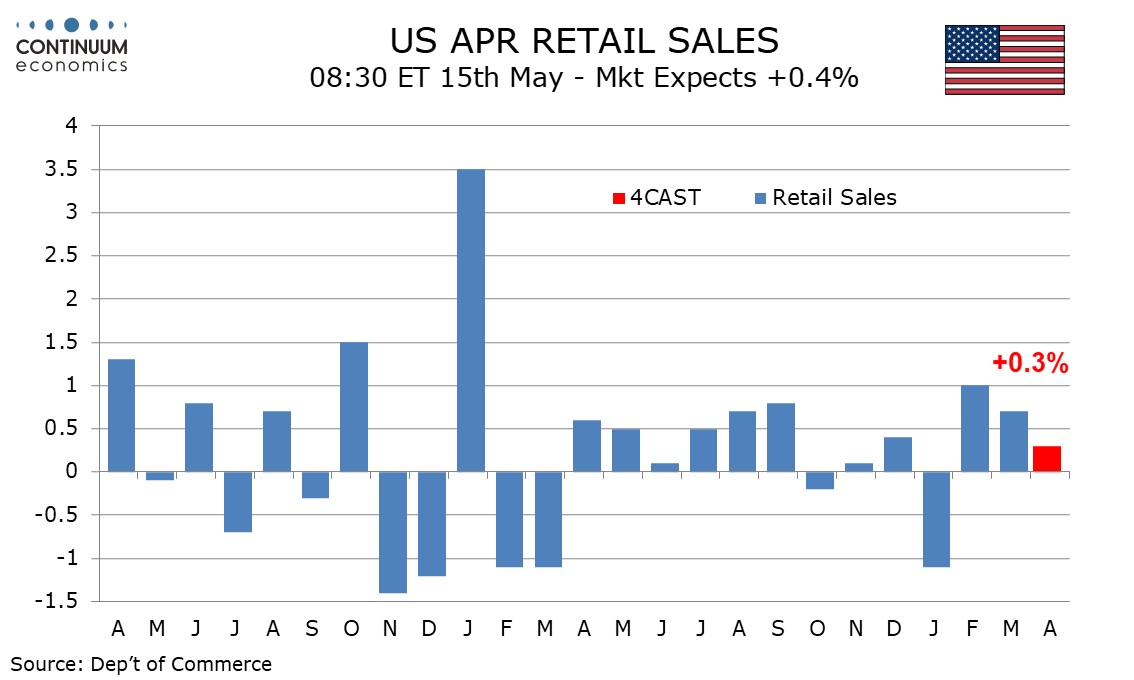

U.S. CPI and Retail Sales Show Some Loss of Momentum in April

May 15, 2024 1:14 PM UTC

April CPI has provided some relief by coming in lower than expected at 0.3% on the headline and while the 0.3% core is on consensus, it is on the soft side at 0.292% before rounding. Retail sales have also lost some momentum in April, unchanged overall, up 0.2% ex autos but down 0.1% ex autos and ga

Asia Open - Overnight Highlights

May 15, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as the greenback yo-yo on stronger PPI and Fed speaker's comment. THB saw the largest gains of 0.41%, followed by MYR 0.25%, SGD 0.13%, PHP 0.04% and INR 0.02%; the biggest losers are IDR 0.12%, KRW 0.07% and TWD 0.02%.

USD/CNH is tradin

May 14, 2024

Preview: Due May 24 - U.S. April Durable Goods Orders - Underlying trend remains near flat

May 14, 2024 6:01 PM UTC

We expect April durable goods orders to fall by 0.8% after a rise of 0.9% in March (after annual revisions were released on May 14) with a 0.3% increase ex transport to follow an unchanged March. Underlying trend remains close to flat.

Preview: Due May 22 - U.S. April Existing Home Sales - No signals for a strong move

May 14, 2024 3:29 PM UTC

We expect existing home sales to be unchanged at 4.19m in April, pausing after a 4.3% decline in March corrected a strong 9.5% increase in February. We expect to see trend move lower in the coming months, but there are no clear signals for a second straight decline in April.

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 14, 2024 2:02 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

U.S. April PPI - Worrying strength, even if surprise in part offset by March revision

May 14, 2024 1:17 PM UTC

April PPI surprised on the upside with gains of 0.5% overall and ex food and energy, with ex food, energy and trade up by 0.4%. The upside surprise is however largely offset by downward revisions to March, both overall and ex food and energy to -0.1% from +0.2%, though March ex food, energy and tr

May 13, 2024

USD flows: USD lifted by higher New York Fed inflation expectauons

May 13, 2024 3:26 PM UTC

The USD has seen a bounce on the New York Fed’s April survey of consumer inflation expectations, showing market sensitivity to the issue. This reinforces a message of stronger inflation expectations in May’s preliminary Michigan CSI report on Friday.

Preview: Due May 14 - U.S. April PPI - New Year strength fading

May 13, 2024 12:26 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

USD/JPY flows: BoJ Purchase decrease and Kato's remark Affecting JPY

May 13, 2024 4:37 AM UTC

Japan's Kato says its natural that monetary policy will revert to positive interest rates

Bank of Japan has reduced the amount of 5-10yr JGBs purchased in its latest operation from 475bn JPY to 425bn JPY, comparing to last operation.

Asia Open - Overnight Highlights

May 13, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as the greenback reversed earlier losses on more hawkish market sentiment. THB saw the largest gains of 0.59%, followed by KRW 0.14%, TWD 0.12%, MYR 0.03% and INR & HKD 0.01%; the biggest losers are CNH & SGD 0.16% CNY 0.1% and IDR 0.08