View:

May 12, 2024

May 10, 2024

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

UK GDP Review: Clearer Growth Momentum But Mainly Import Led?

May 10, 2024 6:26 AM UTC

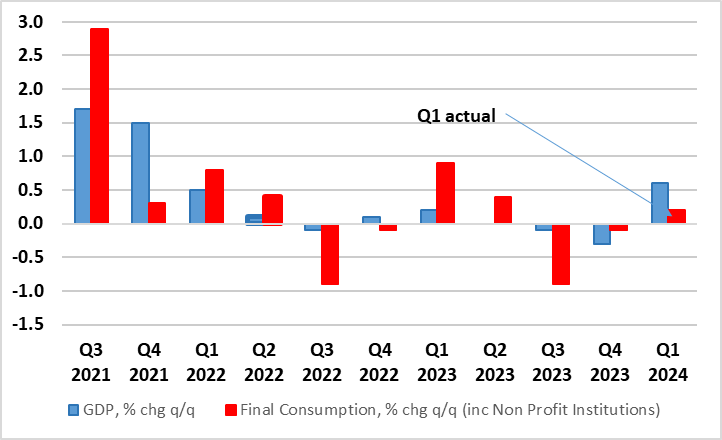

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded boun

May 09, 2024

Mexico CPI Review: 0.2% Growth in April

May 9, 2024 6:11 PM UTC

April's CPI data, despite a 0.2% m/m growth, reveals a significant y/y uptick to 4.6% from March's 4.4%, challenging norms due to electricity tariff adjustments. Core CPI maintained stability with a 0.2% increase, while Core Goods CPI rose by 0.3% and Services CPI by 0.1%, accumulating a 5.2% y/y gr

BoE Review: Data Dependent Easing Bias Clearer?

May 9, 2024 12:52 PM UTC

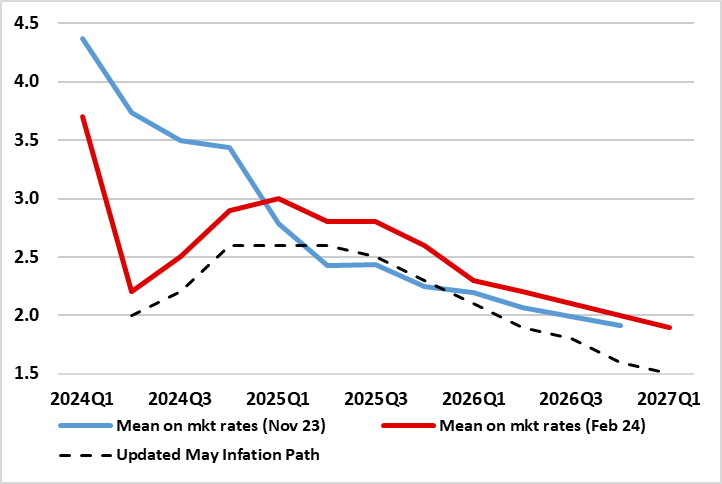

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted

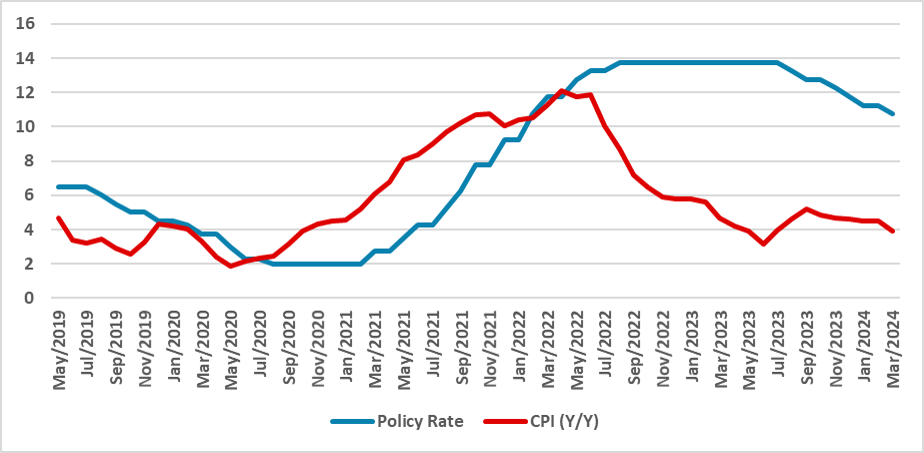

CBRT Lifts End-Year Inflation Forecast to 38%

May 9, 2024 10:22 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38% citing that the rebalancing process for demand will be more delayed compared to what was projected that in the first inflation rep

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

Ukraine War Update: Major Russian Offensive is Expected This Summer Despite U.S. Military Aid

May 8, 2024 12:06 PM UTC

Bottom Line: The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion warti

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

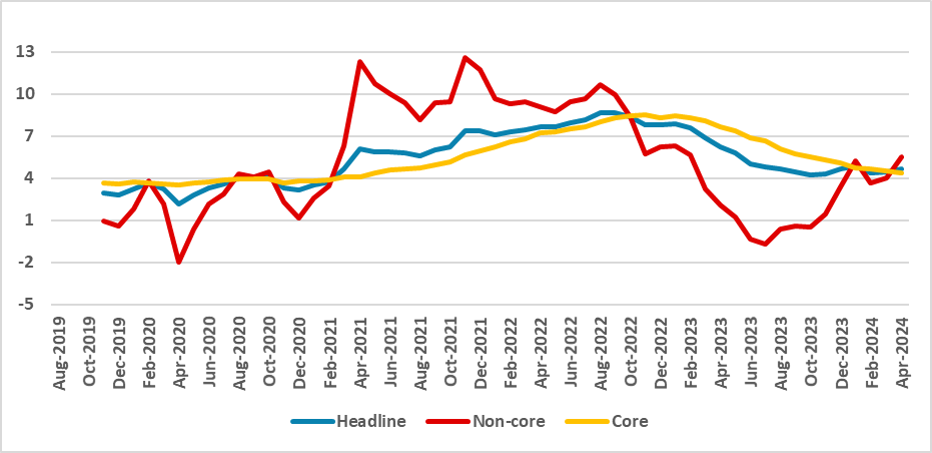

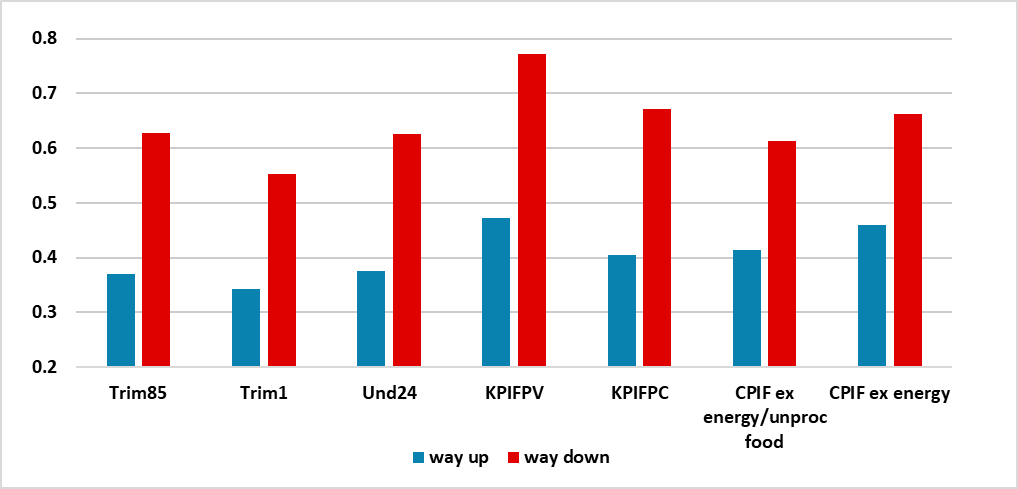

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

May 06, 2024

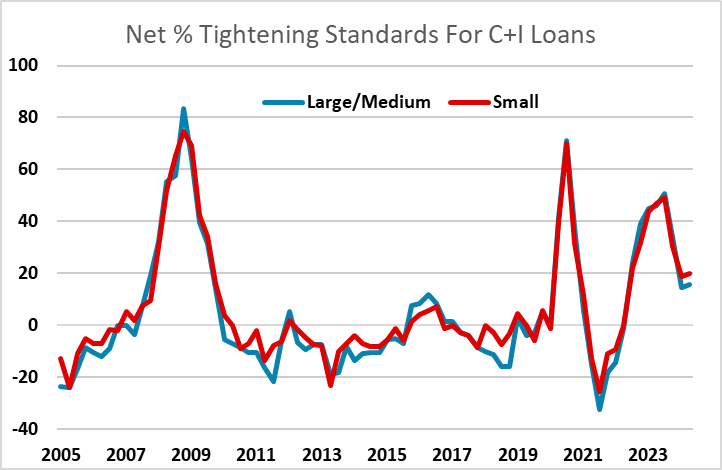

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp