View:

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

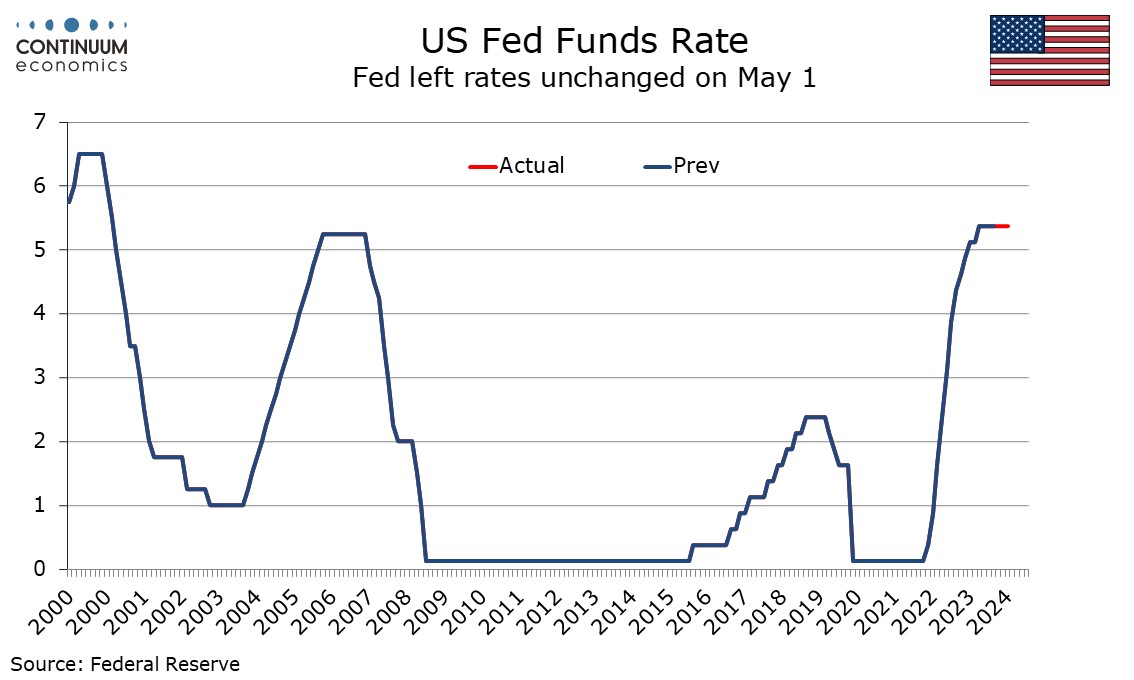

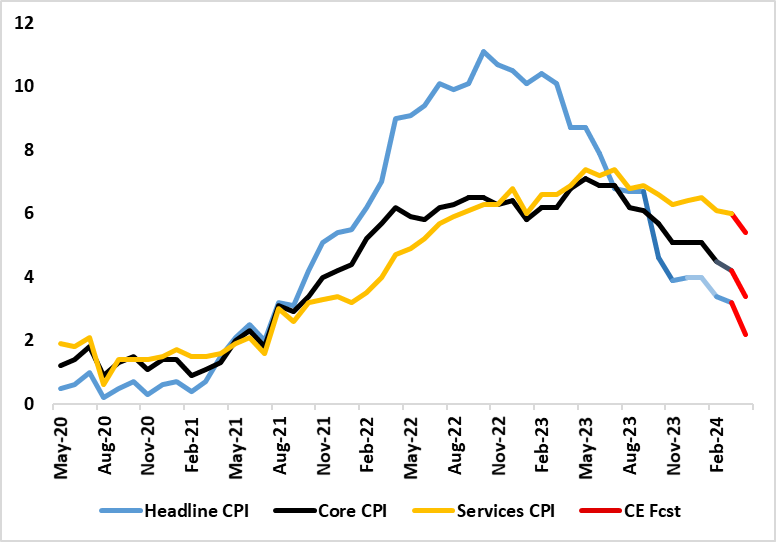

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

USD flows: USD lifted by higher New York Fed inflation expectauons

May 13, 2024 3:26 PM UTC

The USD has seen a bounce on the New York Fed’s April survey of consumer inflation expectations, showing market sensitivity to the issue. This reinforces a message of stronger inflation expectations in May’s preliminary Michigan CSI report on Friday.

Preview: Due May 14 - U.S. April PPI - New Year strength fading

May 13, 2024 12:26 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

UK CPI Inflation Preview (May 22): Inflation to Fall Further and More Broadly

May 13, 2024 12:10 PM UTC

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even existence if any start to an easing cycle. But perhaps the CPI data is the most crucial making the looming April data all the more important for markets as they weigh the chances of an initial rat

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

Watts at Stake: India's Looming Power Shortage

May 13, 2024 6:58 AM UTC

India's power sector faces rising demand and power shortages, sparking fears of the most significant power shortfall in a decade. With coal imports continuing to rise and hydropower generation declining, India's aim to become a manufacturing hub could become challenging. Energy transition is likely

USD/JPY flows: BoJ Purchase decrease and Kato's remark Affecting JPY

May 13, 2024 4:37 AM UTC

Japan's Kato says its natural that monetary policy will revert to positive interest rates

Bank of Japan has reduced the amount of 5-10yr JGBs purchased in its latest operation from 475bn JPY to 425bn JPY, comparing to last operation.